“Adrian Gattenhof from Mullumbimby and the late Alleyne Thompson from Duranbah with placards at the NSW Govt. Cabinet meeting in Murwillumbah on 20 March 2001, when the now disgraced, then DPI Minister Ian Macdonald was confronted by us three reformers.”

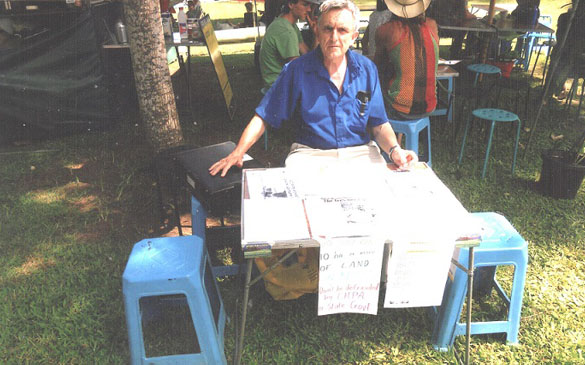

Channon Market 10th Feb 2013

“A mean looking man at a North Coast market encouraging others to not be conned into paying money to a NSW Govt. appointed LHPA/LLS who sit in ratepayer funded offices sending out bills for their imagined services to the rural sector.”

Rural Lands Protection Group of NSW Land Owners

Rural lands are the most vital part of the environment for all land dwelling species on this planet. They provide most of the food for our survival.

Small and large landholders in New South Wales are being unjustly taxed by local Rural Lands Protection Boards (from Jan 2009 renamed Livestock Health and Pest Authority which then became Local Land Services in 2013), who demand that annual amounts of $40 and upwards be paid to provide veterinary assistance and disease control for livestock farmers, with promises of feral animal eradication.

However, most small landowners receive no assistance at all from this Authority, even if they know how to request it. If their levies are not paid, the Authority takes legal action and threatens to seize possessions of the property’s occupier (even if a tenant) or to sell the property. Most ratepayers feel they don’t need any services from the LHPAs, now LLS as they have no livestock, while often spending their own money restoring the environment with no help from the government or the statutory authority charged with assisting them. If you find yourself in this frustrating situation there is now hope for reform, as a dedicated group of ratepayers have organised themselves to fight this inequitable tax.

The Rural Lands Protection Group (RLPG) is building a disciplined campaign to oppose the enforcement of these ridiculous levies and regulations, while lobbying for their removal. These levies or state taxes are actually an excise on land and primary production only in NSW, which is illegal under the Australian Constitution.

EVOLUTION, FUNCTION AND DISSOLUTION

Information about the history of this government sponsored scam can be obtained here.

Click here to reach the llsclassaction.com web site.

While we cannot offer professional legal advice to protect your valuable freehold title from theft by this despicable qango, my own legal defences have saved me from rate and levy payments with court costs, as well as near total loss by auction; at the same time exacting severe and humiliating financial losses upon them, along with shameful resignations of their officers.

Click here for Legal Defences.

If you would like to join us and contribute to genuine rural lands protection instead of paying a useless bureaucracy to protect their own privileged positions